Virgin gold district discovery with higher grade (+1g/t) than similar style deposits in Yukon, including producing Eagle mine (0.65g/t reserve grade).

Tier one scale possibility with +20Moz guestimate by industry figures based on grade and approx. dimensions drilled to date.

Bright spot in a dead market, hitting 52-week high while peers at 52-week lows.

A look at the potential and challenges ahead for Snowline and other Yukon explorers.

Gold: US$1,697/oz -3.58% 30 day, -6.48% 1 yr

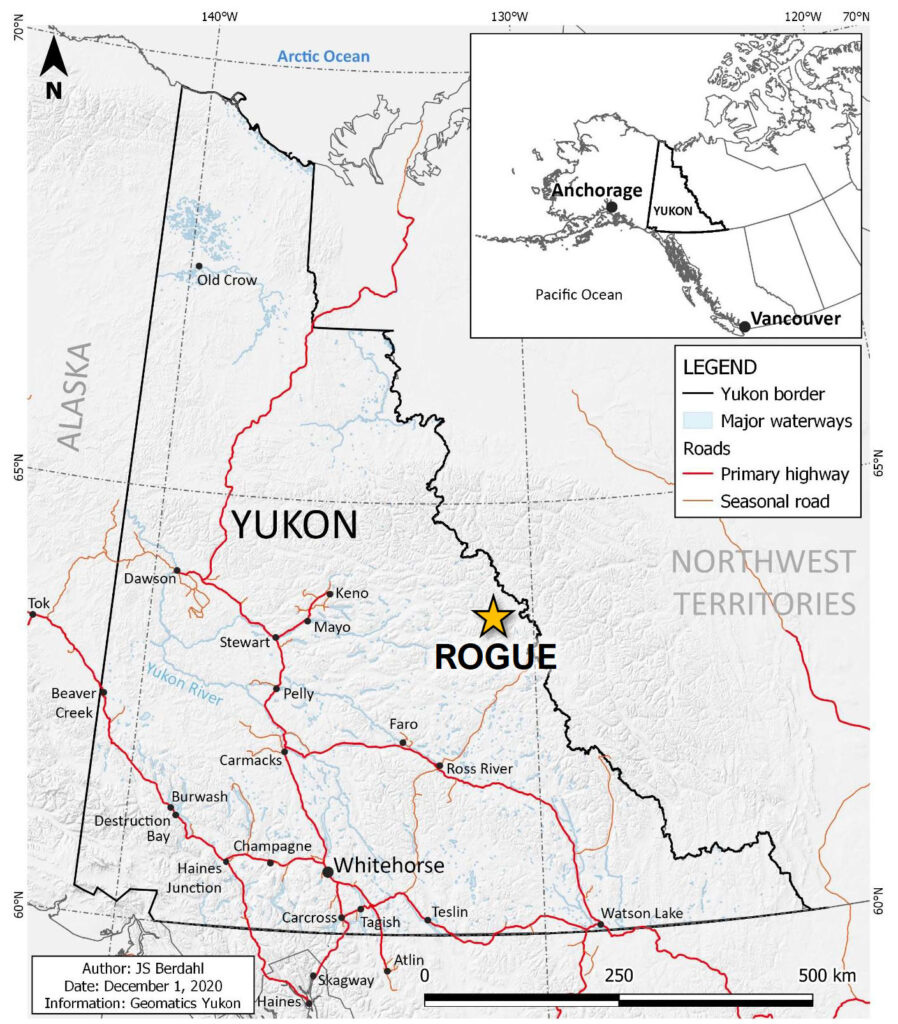

Over a century ago 100,000 men piled into Canada’s Yukon in search of treasure. Now, a troupe of gold legends and retail investors are going into even more remote corners of the territory in search of massive treasure with Snowline Gold (CSE:SGD, C$241M), which some believe may have found the biggest gold find in decades at Rogue.

Yukon offers the exciting possibility and rewards for investors of virgin discoveries such as Snowline and eventual M&A such as Goldcorp’s (now Newmont (NYSE:NEM) C$520 million acquisition of the Kaminak Gold in 2016 for the Coffee project, the biggest recent success of note.

Yukon is home to one of Canada’s most recently developed gold mines in the shape of Victoria Gold’s (TSX:VGCX, C$522M) Eagle mine, one of the largest heap leach projects in the Americas.

The enchanting smell of fireweed adds to the excitement of the fantastic geology the territory has to offer courtesy of the Tintana Fault, the main geological feature in the region, which arcs westward into Alaska where it hosts the producing Pogo and Fort Knox gold mines.

The Yukon territorial government recognises that mineral endowment is one of its strengths and actively supports mineral development, as do many of the territory’s first nations. This extends beyond lip service with the government seeking to develop the infrastructure that projects will need, both road and power.

An example of the former is the development of the Carmacks bypass, whose construction is underway and which is being funded by the federal government, which will benefit Western Copper & Gold’s (TSX:WRN, C$248M) Casino project and Newmont’s Coffee.

The territory’s efforts to develop grid power will be equally significant, particularly as miners are now living within the energy decarbonisation paradigm where installing diesel powered generation for a project is very much déclassé.

“We need to work to get mining off fossil fuels. We are mapping out a path as a territory to be sustainable, we are completely committed as a government,” minister of energy, mines and resources John Streicher told Gold Report during a mine tour visit in July organised by the Yukon Mining Alliance.

Snowline Gold (SGD:CSE)

The company generating buzz during that visit was Snowline Gold due to its high-grade exploration results at its Rogue project and potential to be sitting on a new massive gold district.

August saw Snowline release a hit of 283M @ 2.3g/t Au in the Valley zone at Rogue, a massive 651-gram metres. This is a very long intercept containing much more gold than is typically encountered in the region, and it enabled the company’s share price to post 52-week highs while most of its peers have been hitting 52-week lows.

Rogue may need to have more than 10Moz of resource to be a viable development project given its location is remote, even by Yukon standards. The project is on the eatern side of Fireweed Zinc (TSXV:FWD, C$52M) Macmillan Pass zinc and Mactung tungsten projects, with no infrastructure to speak of.

I first met Snowline CEO Scott Berdahl, a professional geologist and prospector by background, in Dawson in June. Scott is from Yukon and followed his father into prospecting giving him the benefit of some 30 years’ of experience and local ‘nose’.

“This is a big regional gold feature, some 80-100km in size that is analogous to the Great Basin in Nevada. The geochemical footprint is jaw-dropping,” he said, adding that he saw potential to host 5Moz.

But in addition to tagging-into a nice system, which is similar to Victoria Gold’s Eagle, Banyan Gold’s (TSXV:BYN, C$100M) Aurmac and Sitka Gold’s (OTC:SITKF, US$21M) RC project, it has much better grade so far. “Most of these sheeted vein and intrusion deposit types have been lower grade, usually under a gram gold,” well-respected Yukon prospector Shawn Ryan told Gold Journal.

Leading sector powerhouse investor Sprott Asset Management has a “bad math” estimate for the potential of the 400m-by-400m core zone of more than 20Moz, while insider Crescat Capital threw out a 50Moz guess!

To date, the company has made two significant discoveries: at the Jupiter target at the Einarson property and Valley at Rogue to the south.

I spoke with Scott the day of the drill intercept mentioned above. “These systems have sub gram average grade which is a workable deposit elsewhere in the world [like Kinross Gold’s (TSX:K, C$5.3B)) Fort Knox and Victoria Gold’s Eagle mines], so we are really happy to see the kind of grades we are seeing in our drill core, which are towards the higher end of the spectrum for this kind of project,” he said.

Berdahl acknowledges the infrastructure challenges facing Rogue, which means it requires costly helicopter-supported drilling for a relatively short season. The Carmacks bypass developent will benefit Western Copper and also Newmont’s Coffee proejcts. However, Atac Resources’ (TSXV:ATC, C$21M) share price did a rapid round trip from 10c to C$9 and back to 10c after a first nation band put a stop to the company’s efforts to permit a road.

With infrastructure an obvious issue, Snowline’s strategy is to swing for the fences with bold step-outs. “We know the bar is high exploring where we are in the Yukon so we are aiming high. We are swinging big and the results we put out this morning where we stepped out 150m across the strike length of the system and 300m down the strike length are a really big step out with a lot of tonnage and grades even better than we got in our discovery holes last year. It is fantastic,” he said.

Snowline has defined sheeted vein mineralisation at Valley over 800m x 700m x 400m. “We have seen really nice veining across holes that are spaced to about 700m apart and we are continuing to test the limits of this system. By the end of the season, we expect to have a very nice picture of this deposit although I suspect it will be open in several directions given the constraints on how much we can do,” he said.

Snowline has also began drilling the Gracie target 4km east of Valley which it thinks is a sibling intrusion although unexposed. “We have drilled into the hornfels we think are above it and hit visible gold. We haven't seen the high vein densities yet but we are just getting started. Hitting on your first hole is certainly not a bad way to start on a prospect,” he said.

Snowline’s exploration effort is supported by raising more than C$25M over the summer at C$1.25 per share—which took a few short weeks for the C$2.50 warrants to be in the money—giving it the financial ammunition to test targets and step out. Investors include Eric Sprott, Crescat Capital and Keith Neumeyer (of First Majestic Silver (NYSE:AG)).

“We founded this company around the idea that there is this unrecognised gold district where we have over 127,000 hectares staked and a much larger data footprint from work previously work we’ve done. This money really allows us to explore on a district scale and with a district level of thinking instead of getting locked into focusing on our Valley discovery. To find something of value is very exciting but it is also a proof of concept so we are in a great position to be able to unlock that much bigger picture,” said Berdahl.

Up on mystery, down on history

There is nothing like a good discovery to excite the investment market and Snowline shows that investors are willing to move where they see something special. Based on its early drilling success, one can expect much more to come from the company.

However, we need to temper what it could be with the cold water bath reality check.

Snowline faces many challenges in addtion to the lack of infrastructure already mentioned. Remote, helicopter-supporting drilling is expensive: C$950/m says Berdahl versus C$200/m or less in Quebec and as low as US$100-150/m in Nevada. Drilling out large deposits takes a lot of drilling over a number of years. A short drilling Arctic summer drilling season (mid-May to mid-October) will extend the timeline to get there as the days are too short and wintry conditions too dangerous for Snowline to drill year round. “We can drill year-round, but at this early stage that just adds too much cost,” said Berdahl.

Drilling out its discoveries could see Snowline looking at +500,000m of drilling. The company could follow the game plan of Great Bear Resources which kept a big enough treasury to drill large step-outs to continually add to the potential of its Dixie project in Red Lake, Ontario. It drilled almost 300,000m at Dixie before eliciting a US$1.4B cash and stock takeover bid in 2021 from Kinross at 40% premium.

Kinross has said it will drill another 200,000m before bringing Dixie to a maiden resource. Drilling 300,000, would cost Snowline about $275M, meaning it would need to raise $$$, which even with the support of Crescat, Sprott and others. At its current share price, that is more than 100M new shares.

Snowline’s share price has more than doubled since I met Scott in Dawson in June, with the company achieving a decent average daily volume of some 340,000 shares. However, with 128M shares oustanding there is likely to be a lot of dilution to come, particularly as Snowline will have seasonal news flow to support its stock price whereas Great Bear was a year-round news machine.

When Goldcorp bid $520M for Kaminak in 2016 Coffee hosted 5.2Moz of resources (including 2.2Moz of reserves) giving a valuation of US$100/oz for its resources. The market is currently valuing gold juniors and developers at about one third of that value, at around US$35/oz (C$46/oz). Using that as a guide, my own bad math calcuation for Snowline’s current C$285M market capitalisation means the market is pricing-in that the company has an implied 6.2Moz at Rogue.

If Sprott is ultimately proved correct in its assumption that Snowline has 20Moz, at US$35/oz, it would imply the potential for Snowline’s market capitalisation to grow to C$920M. And for Snowline to get to the same market capitalisation as Kaminak’s take out price implies it will need to define about 11.3Moz! “Snowline will need to get f**king massive,” as a friend said.

A clear takeavway from this is that mining speculators are clearly alive and well for exciting new stories, while also being over exuberant in rapidly pricing in future potential, which, in this instance, will take Snowline many years to fulfil with the drill bit.

For anyone looking for more rain on this parade, it is also worth remembering that developing projects in Yukon is tough. While Victoria Gold has developed Eagle into a successful gold mine, it was a rough trip for early investors. Cost overruns saw the capex inflate about one third from US$370M in the 2016 feasibility to US$487.2M in 2020, resulting in a flurry of additional equity financings and a soul-destroying 15:1 share consolidation for investors in 2019.

Obstacles

Infrastructure - lack of roads

Infrastructure - lack of grid power

High drilling costs and a lot of drilling required

Financing $$$ and shareholder dilution to define a large deposit

Juniors to watch in Yukon

Victoria Gold (TSX:VGCX, C$517M) single asset gold producer, M&A target or protagonist

Western Copper & Gold (TSX:WRN, C$248M) advanced stage copper explorer with Rio Tinto as a partner

Minto Metals (TSXV:MNTO, C$139M) copper producer with exploration potential

Banyan Gold (TSXV:BYN, C$100M) gold explorer with rapidly growing resource base and M&A candidate

Fireweed Metals (TSXV:FWZ, C$52M) high-grade zinc explorer with a tugnsten kicker

By no means an exhaustive list …

Banyan Gold

While Snowline is in its early days, a more advanced and obvious takeover target in Yukon is Banyan Gold (TSXV:BYN, C$100M) which published a 4Moz resource update for its Aurmac deposit in May and with 60,000m in its drilling plan for this year, management believes the resource will number 6-8Moz the next time it is calculated.

The company raised an upsized C$17M in June and is well-funded to deliver on that. What makes BYN an obvious potential deal is that it is adjacent to 200,000oz/y producer Victoria Gold. The Powerline deposit at Aurmac hosts 152 million tonnes grading 0.59g/t and the Airstrip deposit 42.5Mt grading 0.64g/t at a 0.2g/t cut-off, which is higher than Victoria's 0.15g/t.

Banyan's president and CEO Tara Christie wants to keep adding ounces before embarking on a PEA and thinks annual production of 200,000oz/y a possibility. "Finding a high-grade starter pit is critical. Victoria's feasibility included mining 0.8g/t during the first two years to give them a two-year payback. When we find something like that, I will do a PEA," Christie told me during a site visit in June.

Having infrastructure is critical in Yukon and Banyan has access to the same road and power infrastructure as Victoria, including a 138kV powerline supplying hydropower from a facility in Mayo, which crosses Banyan's aptly named Powerline deposit. A combination with Victoria would also bring Aurmac within the shadow of Eagle's permits, cutting the time to permit it and benefiting from Victoria’s experience of having already successfully permitted a mine in the territory.

Victoria president and CEO John McConnell recognises his company’s vulnerability as a single asset producer and while he is working hard to quickly pay down the debt he raised to build Eagle mine, debottlenecking to increase production and exploring to extend mine life, at some point Victoria will face a deal or be dealt scenario.

Victoria was an early investor in Banyan and owns 12.4%, but as a 5% shareholder herself, Christie wants any potential hook-up to make sense for her investors, and would expect Victoria, or any other suitor, to pay full and fair value. "We will only combine if it is good value for my shareholders: it cannot only be good for Victoria's shareholders. I want to test many targets we have and would be unhappy with a 40% premium at the current share price and see someone else make a discovery," she said.

Christie and McConnell are married, which adds another layer onto this story, but not one which would preclude a deal being made as each company has taken corporate governance steps to ensure that if and when the time comes to undertake what some see as an inevitable transaction, conflicts of interest will not be an issue, with each party having plenty of independent directors to manage the process. There is also a bigger picture angle here as with large gold miners looking for projects with a 500,000oz/y of annual production, Victoria-Banyan has the makings of a double-play in which a bigger company could take them both.

That’s all for now. Plenty of news is expected in the coming weeks as the sector moves closer to the September conference season.

This is a new publication so all feedback and comments are welcome. Tell us want you want to hear about, and hit the share button to send to others you think would be interested in receiving this.

Paul

Thanks for reading Gold Journal! Subscribe for free to receive new posts and support our work. Also follow @PaulHarrisGold on Twitter.

✓

Thank you for that awesome look into Banyan and Victoria especially. I'm a subscriber now!